The Sunday Times in London reports:

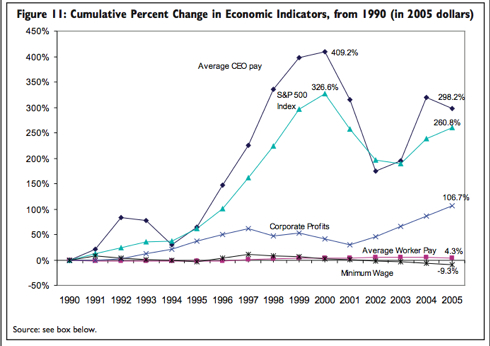

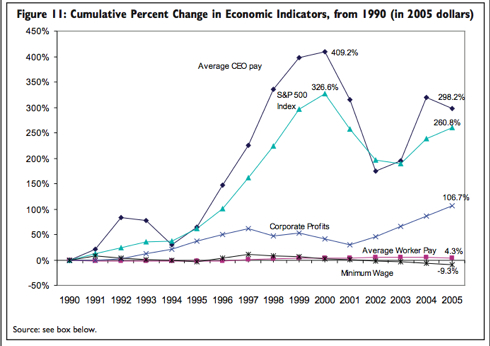

Do we now have enough examples of disastrous compensation initiatives (Mozillo, Fuld, Fiorina, Wagner, Cayne, et al) to annihilate the argument that contemporary levels of executive compensation are a direct and necessary outcome of market forces for top talent? I'm including a chart of CEO-to-worker pay from 1965 so as to be able to visualize how extraordinary these conditions are and one comparing a number of benchmarks from 1990-2005 including corporate profits and the S&P 500:

Let us keep in mind that few of these CEOs were the entrepreneurs or innovators who began, funded, or took the significant risks that started and built these businesses. In fact, many of the companies at hand are significantly older than the executives themselves (Mozillo excluded, he actually did begin Countrywide). All of the executives listed and certainly others have generated extremely negative shareholder value (last week, GM was worth less than it was in 1929) while being handsomely paid to do so.

What is to be done? I am not an advocate of federally mandated compensation limits. I don't believe they'd be effective, as inevitable loopholes and other games would be found to funnel the money to the top. Also, why should the government force shareholders from spending their money foolishly? Greater transparency is certainly welcome, but it's not as if investors haven't known that Mozillo, Fuld, Wagner or the others were taking home a boat load of money.

Shareholders, very clearly, have done a terrible job of providing the "market forces" to protect their own interests in these scenarios. This may appear as a social injustice, but if it is, I do not believe it is so on the compensation side. If anything, injustice is occurring on the taxation side, but that is a very different blog post. From this vantage point, it appears that shareholders are happy to overpay poorly performing executives, as it has become common, repeated, and widespread practice.

I don't have any particularly brilliant ideas on 'correcting' this 'problem,' as shareholders have the power to prevent these excesses and have chosen not to. None of the cases mentioned were instances of fraud (except, possibly the Lehman scenario, which remains to be seen), so I guess there is a net benefit for shareholders outside of share price appreciation for giving their money to these handful of individuals that I do not comprehend. Maybe the executives have gamed the system without breaking the law? Maybe the system and brand of capitalism we've come to subscribe to is an inaccurate or insufficient hypothesis to explaining human economic behavior? Maybe something completely other?

Any ideas on the 'problem' or its 'solutions' (quotes used, because it is not self-evident that this is a problem)?

The Lehman Brothers board signed off on more than $100m (£59m) in payouts to five top executives just three days before the bank went bankrupt leaving thousands of employees out of work in London.$100M amongst 5 people, all of whom were executives of the worst bank failure in history. Were they being rewarded based on merit? Clearly not. All of these executives and the compensation committee must have been aware of the bank's imminent failure. Foregoing $100M would not have saved the bank, but it would have left a lot of money behind for all sorts of costs associated with the aftermath of its failure.

Do we now have enough examples of disastrous compensation initiatives (Mozillo, Fuld, Fiorina, Wagner, Cayne, et al) to annihilate the argument that contemporary levels of executive compensation are a direct and necessary outcome of market forces for top talent? I'm including a chart of CEO-to-worker pay from 1965 so as to be able to visualize how extraordinary these conditions are and one comparing a number of benchmarks from 1990-2005 including corporate profits and the S&P 500:

Let us keep in mind that few of these CEOs were the entrepreneurs or innovators who began, funded, or took the significant risks that started and built these businesses. In fact, many of the companies at hand are significantly older than the executives themselves (Mozillo excluded, he actually did begin Countrywide). All of the executives listed and certainly others have generated extremely negative shareholder value (last week, GM was worth less than it was in 1929) while being handsomely paid to do so.

What is to be done? I am not an advocate of federally mandated compensation limits. I don't believe they'd be effective, as inevitable loopholes and other games would be found to funnel the money to the top. Also, why should the government force shareholders from spending their money foolishly? Greater transparency is certainly welcome, but it's not as if investors haven't known that Mozillo, Fuld, Wagner or the others were taking home a boat load of money.

Shareholders, very clearly, have done a terrible job of providing the "market forces" to protect their own interests in these scenarios. This may appear as a social injustice, but if it is, I do not believe it is so on the compensation side. If anything, injustice is occurring on the taxation side, but that is a very different blog post. From this vantage point, it appears that shareholders are happy to overpay poorly performing executives, as it has become common, repeated, and widespread practice.

I don't have any particularly brilliant ideas on 'correcting' this 'problem,' as shareholders have the power to prevent these excesses and have chosen not to. None of the cases mentioned were instances of fraud (except, possibly the Lehman scenario, which remains to be seen), so I guess there is a net benefit for shareholders outside of share price appreciation for giving their money to these handful of individuals that I do not comprehend. Maybe the executives have gamed the system without breaking the law? Maybe the system and brand of capitalism we've come to subscribe to is an inaccurate or insufficient hypothesis to explaining human economic behavior? Maybe something completely other?

Any ideas on the 'problem' or its 'solutions' (quotes used, because it is not self-evident that this is a problem)?

It is a problem, and there is a simple solution. Return to a graduated tax rate schedule similar, except for the income values so as to account for inflation, to that in force during the Eisenhower Administration. The table here shows the top marginal rates in each year since the inception of the personal income tax.

ReplyDeletehttp://www.truthandpolitics.org/top-rates.php