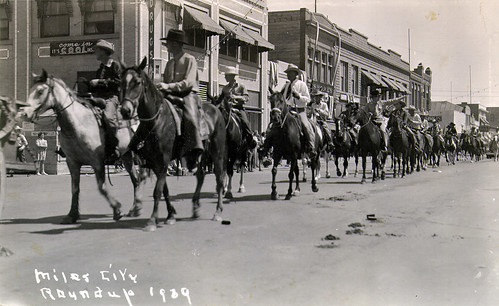

Image via lantram at Flickr

Politics & History

- Sherman Miles revisits the lead up to the attack upon Pearl Harbor in The Atlantic:

Pearl Harbor struck a country satiated with war's alarms. True, we had put through the draft and had actually reached the shooting stage with German submarines. But as a people we were still talking of war, without really accepting its imminence. Then, into our national complacency, came a surprise blow at our strongest point!

- Martin Indyk, former US Ambassador to Israel and currently Director of the Saban Center for Middle East Policy at the Brookings Institution, who I met while in Israel, along with Richard Haass, President of the Council on Foreign Relations, write A New US Strategy for the Middle East in Foreign Affairs

: Summary: To be successful in the Middle East, the Obama administration will need to move beyond Iraq, find ways to deal constructively with Iran, and forge a final-status Israeli-Palestinian agreement.

- Fawaz A. Gerges speculates on how a Palestinian-Israeli resolution may come about and what it may look like within and Obama administration at Dissent Magazine:

Contrary to the doomsayers and naysayers, there now exists a real potential for a breakthrough in the one-hundred-year-old Middle East crisis. A relative consensus appears to have emerged in the Arab world and Israel alike that a comprehensive peace settlement, as opposed to bilateral agreements, will be most viable and durable. Top leaders in both camps reference the Arab peace plan advanced by Saudi Arabia in 2002 and endorsed by the Arab League which involves recognition of Israel by the Arab world in exchange for its withdrawal to pre-1967 borders.

- New York Times Sunday Magazine has Roger Cohen, editor of The Times and International Herald Tribune examine what a 21st century Cuba may look like:

...on Havana’s streets the name Obama is often uttered as if it were a shibboleth. Many people want to believe he offers a way out of the Cuban web that Fidel’s infinite adroitness and intermittent ruthlessness have woven over a half-century.

Business & Money

- In The Nation John Nichols explores the fascinating labor sit-in occurring right now within a Chicago factory:

"We're going to stay here until we win justice," says Blanca Funes, 55, of Chicago, who was one of the UE members occupying the Republic factory over the weekend for several hours..."Their goal is to at least get the compensation that workers are owed; they also seek the resumption of operations at the plant," explains the union. "All 260 members of the local were laid off Friday in a sudden plant closing, brought on by Bank of America cutting off operating credit to the company. The bank even refused to authorize the release of money to Republic needed to pay workers their earned vacation pay, and compensation they are owed under the federal WARN Act because they were not given the legally-required notice that the plant was about to close."

- BusinessWeek takes an in depth look at the 'un-retired' with Heather Green's cover story:

These are The Unretired. Seniors who thought they were set for life just a year ago now face the prospect of going back to work for two, five, even 10 years. They're sprucing up their résumés, calling old work contacts, and flocking to employment sites. There are no reliable stats yet on how many retirees are looking for work, but there are clear signs the number is growing. RetirementJobs.com, the largest career site for people over 50, saw traffic more than double, from 250,000 visitors in July to 600,000 in November. In April, before the worst of the market downturn, a survey conducted by the seniors group AARP found that 17% of responding retirees over 50 were considering or already going back to work.

- Boston Globe publishes "A Field Guide to Economics and Finance Blogs:"

As the bailout plan unfolded, the bloggers offered historical context along with cutting critiques of the proposal. More important still, they offered counterproposals: direct capital injections into banks, for example, or direct purchases of mortgages. Many of their readers began badgering their senators and representatives to oppose the plan. A few weeks later, Congress rebuffed Paulson, sending shockwaves through global financial markets.

- American Public Media, an amazing resource and the second largest producer of public radio programming has released their Whiteboard Series, a number of extraordinarily informative videos on the financial crisis such as this one:

How credit cards become asset-backed bonds from Marketplace on Vimeo.

Arts & Humanities

- Jenny Eliscu explores "Rocks Best Scene" for Rolling Stone:

Laurel Canyon is one of rock's most mythic neighborhoods: This is where Crosby, Stills, Nash and Young first folded their voices into one beautiful harmony; where Zappa welcomed artists including Hendrix and Mick Jagger to parties at his infamous "Log Cabin" in 1968. Laurel Canyon was the inspiration for the Doors' "Love Street," the Mamas and the Papas' "12:30 (Young Girls Are Coming to the Canyon)," CSNY's "Our House" and an entire album by British blues legend John Mayall. It's where music-business legends David Geffen, Jac Holtzman and Elliot Roberts helped build the recording careers of the singer-songwriters who defined the very essence of the Sixties California sound.

- The Christian Science Monitor has released their "Best Novels of 2008" list.

- Three stories published by the Paris Review were nominated for the 2008 National Magazine Award and all of them are available for free online:

- “Monsieur Kalashnikov” by André Aciman

- “Speak No Evil” by Uzodinma Iweala

- “Icebergs” by Alistair Morgan

- Art Basel began on December 3 and ends today. Financial Times' Georgina Adams takes a look (free registration may be required):

Light relief at the fair’s opening night was offered by the Japanese art superstar Takashi Murakami, who dressed up in one of his plush flowerballs. He didn’t have to fool about for long, as the rapper Pharrell Williams (of N.E.R.D. and the Neptunes) quickly acquired the piece, “Gigantic Plush Flowerball Small”, for a cool $70,000.

0comments:

Post a Comment

Please post your comment(s) here. To reply to a specific comment, be sure to paste the appropriate @ displayed into the box below as the first line.

Post a Comment